ECU personal finance instructors inspire students to save $100,000

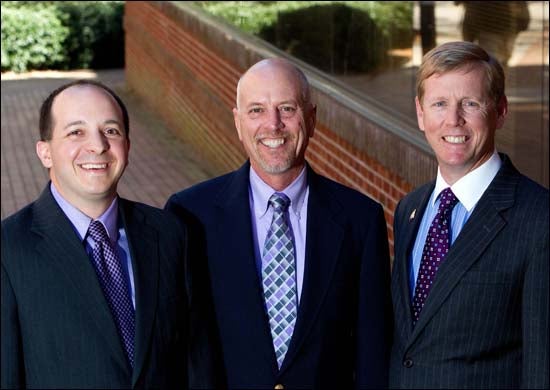

ECU College of Business professors, left to right, Bill Pratt, Len Rhodes and Mark Weitzel taught students about saving money during a personal finance class at East Carolina University. (Photo by Cliff Hollis)

Three personal finance instructors in the East Carolina University College of Business challenged their students to save $50,000 this past semester by taking tips and ideas from class to change their spending behaviors. Together the 500 students saved more than $130,000.

“We were hoping to help our students save up to $50,000 for the year, averaging to $100 per student,” said Bill Pratt, one of the instructors. “I couldn’t help but smile as I tallied the amount of savings.”

The challenge was simple: students were asked to submit any changes in their behavior that resulted in spending less and saving more ̶ even securing a paid internship or part-time job counted. The submission did not count as part of their course grade; instead student names were entered into a drawing for several $50 gift cards.

“We begin the semester by discussing jobs, careers and the importance of internships. From there we move into basic financial topics such as how to create a college budget, how to pay for college, how to save on the cost of a car, how to buy insurance and many other personal finance topics,” said Mark Weitzel, who created the course more than 10 years ago.

“We wanted a fun way to demonstrate to our students that making good financial decisions as a result of what they learn in class is easy and will make a real difference in their lives.”

The savings ranged from reducing the number of times students dine out or buy gourmet coffee to saving thousands of dollars on the purchase of a car. One student saved an average of $100 per month by riding his bike to school. Another student stopped buying a snack before her first class and saved more than $50 each month.

One couple kept heating and cooling costs to a minimum by turning the thermostat low in the winter and high in the summer, bundling up when it was cold and taking advantage of cool mornings in the summer by opening windows. Some students even earned a paid internship or asked for and received a pay raise at their job. One student in particular applied to be a resident advisor on campus and was offered the position, which covers room and board and provides a monthly stipend.

“Our goal is to teach students enough about money so they know the right questions to ask and where to find the answers they need. We want our students to know enough so that no one can take advantage of their financial inexperience,” said Len Rhodes, one of the instructors.

The personal finance class at ECU is a three credit hour elective course that fills to its 500 student capacity each semester. The instructors authored the textbook for the class and all net proceeds from the sale of the book go to financial literacy initiatives on ECU’s campus.

The instructors also recently penned a book called “How to Keep Your Kid from Moving Back Home after College,” which gives parents the tools and knowledge they need to help their children develop good personal financial habits.

For more information about ECU’s financial literacy initiatives or the personal finance course, contact teaching instructor Mark Weitzel at weitzelm@ecu.edu.